This article is for you if you are looking for a Bankruptcy Attorney West Valley City Utah.If you and your spouse are on good terms, then consider a bankruptcy before the divorce. By filing a bankruptcy jointly the marital debts will be addressed under one bankruptcy case. You will also wipe out your joint debts together and may also be able to increase your property exemption amounts. Bankruptcy may also eliminate contracts that neither one of you wants, like car leases that cost too much or mortgages on houses that are completely underwater. It also may make the divorce action go more smoothly since there is very little in debt to be argued about. For example if you qualify for a Chapter 7 bankruptcy you should be finish in about 90 days.

Bankruptcy Law

Bankruptcy laws focus on helping individuals solve and repay their debts after they have suffered heavy losses. In Utah, there were bankruptcy laws as early as 1800. However, the first voluntary bankruptcy laws were allowed through the Acts of 1841 and in 1867. These laws along with the Bankruptcy Act in 1898 are what our modern debtor/creditor relation system are based on. It is common to hear that a person in a bad financial situation may “declare bankruptcy. Bankruptcy law is not always the first career path that law students think of, but it can be quite exciting and fulfilling. Federal bankruptcy laws, which govern nearly all bankruptcy proceedings, are statutory laws outlined in Title 11 of the United States Code. Because one code governs all bankruptcy proceedings in the country, this area of law tends to be very uniform and precise. In fact, many bankruptcy attorneys find this area of practice enjoyable for that very reason; often the answer they are searching for is outlined directly in the code itself. In particular, there are three common types of bankruptcy proceedings. Chapter 7 of the Code applies to individual petitions, while Chapter 11 proceedings are filed by businesses. Finally, Chapter 13 proceedings govern wage earners; petitions under this chapter ask the court for more time to allow a debtor to pay off his or her debts while earning a steady income.

Some Mistakes To Avoid In West Valley City Include:

• Continuing to Use Credit: Some people may make purchases with credit weeks or months before filing bankruptcy. They may also make payday advances. However, conducting these transactions may raise a negative implication regarding whether the filer is filing bankruptcy in good faith. In some situations, bankruptcy may even be considered fraudulent. In certain circumstances, a bankruptcy petition may be denied, such as if there was a recent payday loan. Even if the bankruptcy court does allow the filing, having recent debt can give creditors grounds to object.

• Transferring Property: In order to protect certain assets, some filers may transfer money or other property into the name of someone else, such as a relative, spouse or child. However, this tactic can also result in a bankruptcy fraud investigation. Furthermore, transferring property out of a person’s name may cause the filer to lose the bankruptcy protection that he or she may have retained. Individuals can file for bankruptcy even if they have assets and they may even be able to keep them but this cannot happen if the filer no longer legally owns the assets.

• Selectively Paying Creditors: Many individuals approach debt as a moral obligation. As such, they may feel that a debt to a friend, relative or employer is even more important and may choose to pay off these debts before filing bankruptcy. However, selectively paying creditors can spell disaster for bankruptcy filers. The bankruptcy trustee is often given the power to sue the individual that was paid back in order to recuperate these funds for the bankruptcy estate.

• Altering Other Financial Transactions: Just as a person should continue to pay debts as he or she normally would and not take any special action, he or she should not take any special action regarding deposits. This includes refraining from making deposits of funds that do not actually belong to the filer or conducting business transactions through a personal account.

• Not Filing Income Tax Returns: A filer’s tax returns are critical as a source of information to complete the necessary filings with the court. They help show the filer’s current earnings and show ownership of certain assets that the bankruptcy lawyer may try to protect. Not having tax returns may result in a dismissal of the bankruptcy case.

• Making a Legal Claim: Even if a filer has a legitimate legal claim against another person or entity, this claim becomes the asset of the bankruptcy estate once the bankruptcy petition is filed.

• Receiving Future Payments: The bankruptcy estate also has an ownership interest in funds that are not yet in the filer’s possession but are anticipated. If a filer takes action to receive future payments like accepting a bonus from work, accepting an inheritance that will be paid in the future or filing a tax return for a refund, the bankruptcy trustee can use these funds to pay creditors.

• Ignoring Collection Actions: Another critical error is allowing a home to get foreclosed or property repossessed. Once a creditor receives a judgment, it can take action to collect a debt owed, such as garnishing wages or a bank account. A bankruptcy lawyer can explain the automatic stay in a bankruptcy action that can protect a debtor from any additional collection actions by creditors.

• Providing Inaccurate Information: The debtor is required to submit important financial information and filings with the court. These documents are typically submitted as sworn testimony with the threat of penalty of perjury. If a filer knowingly misrepresents information, he or she may be subject to criminal prosecution.

• Not Hiring a Lawyer: Bankruptcy is a complex area of the law, which is why some lawyers focus their entire practice on this particular aspect of the law. A bankruptcy lawyer is familiar with the documents that must be submitted to the court and can help complete this information. He or she can also provide advice throughout the process so that the debtor stays informed of his or her rights and avoids making costly mistakes. When you’re experiencing financial stress, it’s tempting to do whatever it takes to alleviate the pressure. However, because you’re only entitled to receive a bankruptcy discharge the order that wipes out your debt every so often, it’s important to ask yourself whether you’re ready to file, or whether you might need to file sometime in the future. In this article, you’ll learn about issues you’ll want to consider before moving forward with a bankruptcy case.

Advantages of Filing Bankruptcy In West Valley City, Utah

Despite its disadvantages, in many cases, filing for bankruptcy is the correct course of action. The advantages of filing for bankruptcy are:

• Filing for bankruptcy will trigger the automatic stay, preventing creditors from taking action to collect their debts, prevent creditors from repossessing property such as cars, including calling you, suing you, or sending you letters. This also puts a stop to many evictions, foreclosures, wage garnishments and utility shutoffs.

• You may be able to discharge your obligation to repay any of your dischargeable debts.

• By using the bankruptcy exemptions, many debtors can go through the bankruptcy process without losing any of their property.

• While a bankruptcy filing will remain on your record for 7-10 years, because many debts can be discharged in bankruptcy, many debtors begin improving their credit rating after filing for bankruptcy.

• Without credit cards, you can learn to live within your income and prevent future financial catastrophes.

• Debtors declaring personal bankruptcy are required to take credit counseling. Therefore, you’ll have education to guide you as you rebuild your credit and learn new financial habits.

Disadvantages of Filing for Bankruptcy In West Valley City, Utah

Because filing for bankruptcy may affect your finances for many years, you should carefully weigh all of your options before filing. Some disadvantages are:

• If you are unable to exempt all of your personal property or real estate under the bankruptcy exemptions, some of your property may be seized by the bankruptcy court and sold to pay your creditors.

• Your bankruptcy will be noted on your credit report for 7-10 years.

• Many credit card companies will automatically cancel your credit cards when you file for bankruptcy. You will have difficulty getting new credit cards or lines of credit.

• A recent bankruptcy filing may hinder your ability to obtain a mortgage or loan for many years.

• Tax refunds from federal, state or local governments may be denied based on your bankruptcy.

• If you are looking for a job or housing, some employers or landlords may look unfavorably on a recent bankruptcy filing.

• You may be precluded from being named a director for limited liability companies.

• After your bankruptcy, some debts, such as student loans, many types of tax debts, liens, support orders (such as child support and alimony), federal and local taxes or fines may be non-dischargeable.

• If you file for Chapter 7 bankruptcy, you will need to wait if you want to file again for at least 8 years. Therefore, if more financial difficulties pile up, you will be precluded from filing for bankruptcy again for some time.

• It can drive up your insurance premiums.

• It can impact a search for employment, since some potential employers run credit checks on candidates for employment.

• Bankruptcy can be embarrassing.

What Do Bankruptcy Lawyers Do?

Bankruptcy lawyers may work on behalf of debtors (the individuals or businesses who owe the debt) or creditors (the individuals or entities to whom a debt is owed). In a bankruptcy proceeding, the ultimate goal is to benefit both the debtor and the creditors, by allowing creditors to become satisfied while still allowing debtors a fresh start financially. Bankruptcy lawyers on both sides of the equation work to facilitate this goal. On a typical day, a lawyer working on a bankruptcy case may draft motions and proceedings to be filed in court, as well as draft responses to motions and other filings.

Bankruptcy lawyers engage in and review discovery documents, and hold meetings with clients and adversaries to discuss how best to move forward. Motions filed in bankruptcy cases will be set to be heard by the court, and lawyers will have to be prepared to argue them. However, junior attorneys in bankruptcy firms may not always get to court to argue these motions – which practice is often left up to the more experienced attorneys. Because of the variety of tasks performed by a bankruptcy lawyer, a variety of skills are needed as well. Bankruptcy lawyers must have a strong understanding of the Bankruptcy Code, as well as excellent legal research and writing skills. Lawyers in this field must be prepared to communicate with clients, as well as negotiate with adversaries in pending proceedings, so strong “people skills” are a must.

Finally, litigation skills are a necessity, even though newer attorneys may not argue in court right off the bat. Bankruptcy lawyers should be ready to argue motions filed in court at any time; a full understanding of the filings involved, as well as well-practiced speaking skills, are a must in this field.

Notifying Creditors of the Bankruptcy

If you’re unable to stop payments before you file, you can speed up the process by notifying an important creditor yourself. Just fax or email a letter to the creditor with the bankruptcy case number, filing date, and the court where you filed especially if you need to stop:

• a pending or ongoing wage garnishment

• an imminent foreclosure sale

• a vehicle repossession, or

• any other matter that would be difficult to unwind.

You can probably keep your checking account in Chapter 7 bankruptcy if the funds are exempt and you don’t owe money to the bank. Most banks will let you keep a checking account open when you file for bankruptcy. However, whether you’ll be able to keep the funds in the checking account is a different question entirely. Whether you can keep the funds in your checking account when filing for Chapter 7 bankruptcy will depend on if you:

• can claim the money in the account as exempt (meaning the trustee cannot take it), and

• owe money to the bank holding your account (for example, you have a credit card with that bank).

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Estate Planning Attorney Centerville Utah

Online Relationship Ends In Divorce

Utah Dissolution And No Fault Divorce In Utah

Should You Separate First Before Divorce?

What Are Asset Protection Trusts?

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

West Valley City, Utah

|

West Valley City, Utah

|

|

|---|---|

| City of West Valley City | |

The Maverik Center in West Valley City, home of the Utah Grizzlies ice hockey team.

|

|

| Motto:

“Progress as promised.”[1]

|

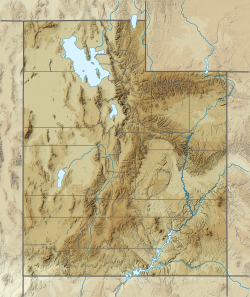

|

Location within Salt Lake County

|

|

| Coordinates: 40°41′21″N 111°59′38″WCoordinates: 40°41′21″N 111°59′38″W | |

| Country | |

| State | |

| County | Salt Lake |

| Settled | 1847 |

| Incorporated | 1980 |

| Government

|

|

| • Mayor | Karen Lang [2] |

| Area | |

| • Total | 35.88 sq mi (92.92 km2) |

| • Land | 35.83 sq mi (92.79 km2) |

| • Water | 0.05 sq mi (0.14 km2) |

| Elevation

|

4,304 ft (1,312 m) |

| Population | |

| • Total | 140,230 |

| • Density | 3,913.76/sq mi (1,511.11/km2) |

| Time zone | UTC−7 (Mountain (MST)) |

| • Summer (DST) | UTC−6 (MDT) |

| Area code(s) | 385, 801 |

| FIPS code | 49-83470[5] |

| GNIS feature ID | 1437843[6] |

| Website | www |

West Valley City is a city in Salt Lake County and a suburb of Salt Lake City in the U.S. state of Utah. The population was 140,230 at the 2020 census,[4] making it the second-largest city in Utah. The city incorporated in 1980 from a large, quickly growing unincorporated area, combining the four communities of Granger, Hunter, Chesterfield, and Redwood. It is home to the Maverik Center and USANA Amphitheatre.

[geocentric_weather id=”02b3d746-3bff-4387-9149-f206cfe1d375″]

[geocentric_about id=”02b3d746-3bff-4387-9149-f206cfe1d375″]

[geocentric_neighborhoods id=”02b3d746-3bff-4387-9149-f206cfe1d375″]

[geocentric_thingstodo id=”02b3d746-3bff-4387-9149-f206cfe1d375″]

[geocentric_busstops id=”02b3d746-3bff-4387-9149-f206cfe1d375″]

[geocentric_mapembed id=”02b3d746-3bff-4387-9149-f206cfe1d375″]

[geocentric_drivingdirections id=”02b3d746-3bff-4387-9149-f206cfe1d375″]

[geocentric_reviews id=”02b3d746-3bff-4387-9149-f206cfe1d375″]