It’s important to understand how people use credit recklessly and end up unable to repay their creditors. Credit is the use of someone else’s money to buy goods or services today with the promise to repay the money at a later date. The person or institution that extends the credit is called the “creditor,” while the person or institution that receives the credit is called the “debtor.” In most cases, the repayment of borrowed money involves the return of the original sum that was borrowed–the principal–plus interest. In some cases, particularly with credit cards and charge cards, interest payments can be eliminated by paying off the entire balance each month.

The use of “credit” is often distinguished from “borrowing” money, despite the similarities between the two terms. Borrowing occurs when the debtor immediately receives a payment from the creditor to make the purchase. For example, to purchase a house a person may “borrow” $150,000 from a bank to complete the deal with the current owner of the house. This $150,000 sum is received by the borrower, and used immediately to pay for the house. Thus, money has changed hands–from creditor (the bank), to borrower (the buyer of the home), to seller (current owner of the home). Credit purchases, on the other hand, do not require money to change hands at the time of the transaction. For example, when a person uses a credit card to make a purchase he is merely promising to repay that sum of money to the issuer of the credit card at a later date. He did not need to apply for a loan with a bank, nor did he need a bank’s cash to complete the transaction.

Reasons for Borrowing Money and Using Credit

One reason for borrowing money or using credit is that buyers can spread the payments for an expensive item over a longer period of time. In effect, the expensive good becomes more affordable in this manner. People who take out a 30-year mortgage, for example, make monthly payments on the principal and interest over a 30-year period to repay their debt to the lending bank. For smaller items, such as consumer durables, people might use credit or apply for installment loans to make the purchase. An installment loan is a type of borrowing where the buyer promises to repay the principal plus interest on a monthly schedule that could range from a few months to several years.

Secondly, the good can be enjoyed immediately. Imagine if you had to wait to buy a house, or a car until you could pay the full price in cash! We could predict that fewer houses and cars would be sold–and that production in many key U.S. industries would slow to a crawl! Of course, consumers don’t purchase houses or cars every day. But consumers do make millions of purchases daily with credit cards and charge cards. Let’s examine the use of so-called plastic money by consumers in the economy today.

Credit Cards

Credit cards are plastic cards that permit a consumer to buy goods or services at a variety of businesses. Traditionally, they were used to buy goods in department stores, restaurants, and other businesses that specialized in consumer goods. During the 1990s the use of credit cards spread into many other types of transactions including pay-at-the-pump gas stations, supermarkets, and the U.S. Post Offices! The Federal Reserve reported that by the mid-1990s the head of family in two-thirds of all U.S. households had a credit card. Some of the major credit cards are MasterCard, Visa, American Express, and the Discover Card. Credit cards are usually issued by banks or other financial institutions.

Comparison shopping for credit cards involves asking the right questions of the firm issuing the card. First, what interest rate will you pay on the unpaid balance? The issuing company insists on a monthly “minimum payment,” but does not require full payment because it can charge you interest on the unpaid balance. Most credit card holders in the United States carry an unpaid balance into the next month. Secondly, does the issuer charge an “annual fee”? This fee could be $25, $50, or more! But there are many credit cards that have no annual fee at all. Third, what types of “finance charges” might be applied to the monthly statement? Finance charges could take many forms, and might be added to a monthly bill simply to record an unpaid balance. Finally, is there is a fee for consistently paying the entire balance each month? Recall that interest and finance charges are linked to unpaid balances. Cardholders who regularly pay their entire balance each month do not pay these fees, hence receive the convenience of credit without paying for this service. Thus, from the card issuer’s perspective, charging a fee for the use of a credit card is fair.

Charge Cards and Bankruptcy

“Charge cards” and “charge accounts” are credit arrangements made between an individual and a specific store or other place of business. Purchases made with charge cards or accounts do not involve loans or cash transfers at the time of the purchase. Many retail businesses issue charge cards or have charge accounts for the convenience of their customers.

The most common types of credit offered by these businesses are a regular charge account, a revolving charge account, and an installment charge account. The regular charge account allows the customer to charge purchases each month up to a certain dollar limit–called the “credit limit.” On regular charge accounts the customer is expected to pay the entire bill at the end of each month. An interest payment is added to the next billing if the customer fails to pay the entire bill. In contrast, the revolving charge account requires the customer to pay only a portion of the monthly bill, and then pay interest on the unpaid balance. This type of account also carries a credit limit. Stores issue a plastic card, similar in appearance to a credit card, to customers who have regular or revolving charge accounts. The installment charge account permits the customer to buy expensive items, and to repay the principal– and interest–in a series of monthly installments.

Using Credit Responsibly To Avoid Bankruptcy

The use of credit has made many types of transactions more convenient. But with credit use comes certain consumer responsibilities. How do the issuers of credit determine whether a person can handle this financial responsibility? And what happens when people cannot pay their bills?

Bankruptcy and Creditworthiness

Creditworthiness is a term used to evaluate whether a person should be granted credit. Major firms that issue credit cards or charge cards often look to “credit bureaus”–businesses designed to collect financial data on people–to help businesses decide whether a person is worthy of receiving the firm’s “plastic.”

So how do credit bureaus decide? Typically, credit bureaus use four criteria to evaluate the creditworthiness of people who apply for credit cards or charge cards. One criterion is the applicant’s income. Naturally, having a steady income is a plus, while having no income is a minus. A second criterion is the applicant’s wealth. Wealth refers to the applicant’s personal assets. Does the applicant own a house, a car, or other valuable assets? The greater the wealth, the greater the chance the card issuer will be repaid in case the card holder tries to default on his debt. A third criterion is the applicant’s past use of credit, or credit history. Has the applicant ever declared bankruptcy? Bankruptcies remain on a person’s credit record for seven to ten years. Having declared bankruptcy in the past is a major minus for the applicant. Finally, credit bureaus attempt to assess the applicant’s character. What kind of education or training does he have? Has he lived in the same location for a period of time? Has his employment been steady? After considering the applicant’s record on each criterion, the credit bureau sends a “credit report” to the firm that requested the credit check. In this report, a recommendation about the creditworthiness is made.

Credit Abuse and Bankruptcy

Credit abuse occurs when people use credit to live beyond their means, and then discover that they cannot pay their bills.

How can people dig their way out of debt? One possible answer is through debt consolidation. To consolidate their debts, debtors sometimes contact a finance company. This finance company then pays off the accumulated bills of the debtor, and replaces them with a single monthly bill. Hence, many bills have been consolidated into a single bill. While the debtor still must pay the bill, plus interest, the repayment schedule is adjusted so that the debtor can make smaller monthly payments over a longer period of time. Another possible solution is to seek help from your state’s Consumer Credit Counseling Service. While these counseling services vary from state to state, most will help you “reschedule” debts. That is, the service will contact your creditors to reduce your monthly payments by spreading them over a longer repayment period. Credit counselors might also suggest that you increase your income by working longer hours or by taking a second job. And there is just one additional requirement–many ask you to destroy all of your credit cards and charge cards!

Chapters in Bankruptcy

Bankruptcy is a legal recognition that an individual or a business cannot pay its debts. There are many sections, or “Chapters,” of the bankruptcy code. These different Chapters try to deal with the different situations debtors find themselves in. The most commonly used Chapters of the bankruptcy code are Chapters 7, 11, and 13. Debtors, assisted by an experienced Ogden Utah bankruptcy lawyer must decide which Chapter best addresses their situation. Thousands of Utah residents file for bankruptcy each year. Bankruptcy is intended to give debtors a new financial start in life.

Chapter 7 Bankruptcy

Chapter 7 bankruptcies apply to individuals. Under Chapter 7, all of the individual’s assets are “liquidated”–sold off–by the courts to pay creditors. To determine what assets the debtor owns, a complete list must be supplied to the federal bankruptcy court. In addition, a full accounting of all liabilities must be presented to the court. Once the assets have been liquidated, creditors start getting paid. First in line is the government! Payment of taxes gets the highest priority. Some financial obligations must be paid even after a Chapter 7 bankruptcy is finalized, including alimony and student loans.

Chapter 11 Bankruptcy

Chapter 11 bankruptcies apply to businesses. By filing under Chapter 11, a business is allowed time to reorganize the firm, and is shielded from persistent creditors. The hope is that through reorganization, the firm can return to profitability and thereby repay some of its debts. While the firm continues with its day-to-day operations, the bankruptcy court reviews the firm’s financial condition, and hears from the firm’s creditors–who may ask the court to investigate the firm for mismanagement or other wrongdoing. The Chapter 11 court proceedings may take years to complete and, even if the firm’s reorganization efforts are successful, there is a distinct possibility that the firm will pay its creditors only a fraction of what is owed to them.

Chapter 13 Bankruptcy

Chapter 13 bankruptcies apply to individuals who are not in the hopeless financial situation that individuals filing under Chapter 7 find themselves in. Under Chapter 13, debtors turn their finances over to the bankruptcy court. After examining the financial documents, the court decides how to deal with the situation. Often, the debtor’s debts are rescheduled so that a portion of the debt can be repaid over time. In addition, a bankruptcy trustee may be appointed to oversee the case for the next few years. It is also common for the debtor’s wages to be tapped by the court to help repay creditors. The benefit to the debtor is that most of his assets are protected under Chapter 13.

If you are considering bankruptcy to pay off your debts, speak to an experienced Ogden Utah bankruptcy lawyer. The lawyer will advise you on the best chapter.

Ogden Utah Bankruptcy Lawyer Free Consultation

Whether you need to file for chapter 7, chapter 13, chapter 11 or chapter 12 bankruptcy in Utah, please call Ascent Law LLC (801) 676-5506 for your Free Consultation. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Do First Time DUI Offenders Go To Jail?

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

Ogden, Utah

|

Ogden, Utah

|

|

|---|---|

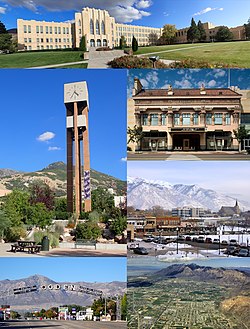

From top left to bottom right: Ogden High School, Weber State University Bell Tower, Peery’s Egyptian Theater, Downtown, Gantry Sign, aerial view

|

|

| Nickname:

Junction City

|

|

| Motto:

Still Untamed

|

|

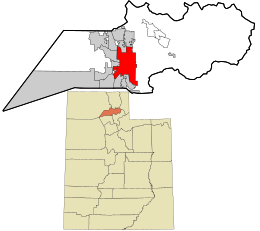

Location in Weber County and the state of Utah

|

|

| Coordinates: 41°13′40″N 111°57′40″WCoordinates: 41°13′40″N 111°57′40″W | |

| Country | United States |

| State | Utah |

| County | Weber |

| Settled | 1844 |

| Incorporated | February 6, 1851 (As Brownsville) |

| Named for | Peter Skene Ogden[1] |

| Government

|

|

| • Type | Council-Mayor |

| • Mayor | Mike Caldwell |

| Area

|

|

| • Total | 27.55 sq mi (71.35 km2) |

| • Land | 27.55 sq mi (71.35 km2) |

| • Water | 0.00 sq mi (0.01 km2) |

| Elevation

|

4,300 ft (1,310 m) |

| Population

(2020)

|

|

| • Total | 87,321 |

| • Density | 3,169.55/sq mi (1,223.84/km2) |

| Demonym | Ogdenite [3] |

| Time zone | UTC−7 (MST) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP Codes |

84201, 84244, 844xx

|

| Area codes | 385, 801 |

| FIPS code | 49-55980[4] |

| GNIS feature ID | 1444049[5] |

| Website | http://ogdencity.com/ |

Ogden /ˈɒɡdən/ is a city in and the county seat of Weber County,[6] Utah, United States, approximately 10 miles (16 km) east of the Great Salt Lake and 40 miles (64 km) north of Salt Lake City. The population was 87,321 in 2020, according to the US Census Bureau, making it Utah’s eighth largest city.[7] The city served as a major railway hub through much of its history,[8] and still handles a great deal of freight rail traffic which makes it a convenient location for manufacturing and commerce. Ogden is also known for its many historic buildings, proximity to the Wasatch Mountains, and as the location of Weber State University.

Ogden is a principal city of the Ogden–Clearfield, Utah Metropolitan Statistical Area (MSA), which includes all of Weber, Morgan, Davis, and Box Elder counties. The 2010 Census placed the Metro population at 597,159.[9] In 2010, Forbes rated the Ogden-Clearfield MSA as the 6th best place to raise a family.[10] Ogden has had a sister city relationship to Hof in Germany since 1954. The current mayor is Mike Caldwell.

[geocentric_weather id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_about id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_neighborhoods id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_thingstodo id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_busstops id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_mapembed id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_drivingdirections id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_reviews id=”795a0e26-23bc-470c-a334-135af97269ac”]