If you or your business is unable to pay off its debts, consult with an experienced South Salt Lake Utah bankruptcy lawyer.

When a debtor is experiencing financial difficulties, the creditors and the debtor have to decide if they can work out a private solution to their problems or seek a court-supervised outcome. One of the impediments to a private solution is information asymmetry. Creditors usually know much less about the debtor’s true financial condition and ability to pay and restructure itself than the debtor. A workout refers to a negotiated agreement between the debtors and their creditors outside the bankruptcy process. The debtor may try to extend the payment terms, which is called extension, or convince creditors to agree to accept a lesser amount than they are owed, which is called composition. A workout differs from a prepackaged bankruptcy in that in a workout the debtor either has already violated the terms of the debt agreements or is about to. In a workout, the debtor tries to convince creditors that they would be financially better off with the new terms of a workout agreement than with the terms of a formal bankruptcy.

After the filing of the bankruptcy petition and the granting of the automatic stay, only the debtor has the right to file a reorganization plan. This period, which is initially 120 days, is known as the exclusivity period. It is rare, however, particularly in larger bankruptcies, to have the plan submitted during that time frame. It is common for the debtor to ask for one or more extensions. Extensions are granted only for cause, but they are not difficult to obtain. However, the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 placed an absolute limit of 18 months on the exclusivity period.

Obtaining Post-petition Credit

One of the problems a near-bankrupt company has is difficulty obtaining credit. If trade creditors are concerned that a company may become bankrupt, they may cut off all additional credit. For companies that are dependent on such credit to survive, this may mean that a bankruptcy filing is accelerated. In fact, if a company may be on the verge of bankruptcy, its vendors may decline to offer them normal credit terms and may insist on cash on delivery. For example, this was the case in 2008 for Linens & Things, which found it had to pay cash to vendors who normally offered them 30 to 60 days to pay. When this happens it elevates a company’s cash needs at a time when it is actually less liquid than normal. This can accelerate the path to a bankruptcy filing.

Sometimes the bankruptcy of one company can create liquidity problems for other companies. For example, when Montgomery Ward filed for bankruptcy in 1997, suppliers became concerned about other companies and preemptively cut off shipments and required cash payments.

To assist bankrupt companies in acquiring essential credit, the code has given postpetition creditors an elevated priority in the bankruptcy process. This type of lending is referred to as debtor-in-possession, or DIP, financing. DIP lenders have an elevated priority over prepetition claims. It is ironic that creditors may be unwilling to extend credit unless the debtor files for bankruptcy so that the creditor can obtain the elevated priority.

A company that seeks such postbankruptcy financing has to file a motion with the bankruptcy court seeking permission to do so. It is not unusual to see companies file such motions at the time they do their Chapter 11 filing or shortly thereafter. Section 364 of the Bankruptcy Code provides that such loans have super-seniority status and have a priority over other secured creditors. Thus, while creditors might not want to lend to the company on an unsecured basis, the fact that the debtor-in-possession may possess significant assets with a high collateral value, combined with the super seniority status, may give them confidence that their loans will be repaid. Various financial institutions specialize in DIP financing.

Credit Conditions and Length of Time in Bankruptcy

The management of cash-strapped companies that have significant assets that can be used as collateral may find the reorganization process comfortable and not have incentive to move the process along. Prepetition creditors, however, would have a different view as they see the claims fall in value as new creditors’ interests are placed ahead of theirs. In weak credit markets that process may work very differently. For example, in the wake of the subprime crisis, credit availability declined sharply. This created more liquidity issues for bankrupt companies—even those that had significant assets that normally could be used as collateral. This, in turn, caused bankruptcy stays to become shorter and for the increased use of prepackaged bankruptcies.

Reorganization Plan

The reorganization plan, which is part of a larger document called the disclosure statement, looks like a prospectus. For larger bankruptcies, it is a long document that contains the plans for the turnaround of the company. The plan is submitted to all the creditors and equityholders’ committees. The plan is approved when each class of creditor and equity holder approves it. Approval is granted if one-half in number and two-thirds in dollar amount of a given class approve the plan. Once the plan is approved, the dissenters are bound by the details of the plan.

Sometimes, to avoid slowdowns that may be caused by lawsuits filed by dissatisfied junior creditors, senior creditors may provide a monetary allocation to junior creditors. This is sometimes referred to as gifting.

A confirmation hearing follows the attainment of the approval of the plan. The hearing is not intended to be a pro forma proceeding, even if the vote is unanimous. The presiding judge must make a determination that the plan meets the standards set forth by the Bankruptcy Code. After the plan is confirmed, the debtor is discharged of all prepetition claims and other claims up to the date of the confirmation hearing. This does not mean that the reorganized company is a debt-free entity. It simply means that it has new obligations that are different from the prior obligations. Ideally, the postconfirmation capital structure is one that will allow the company to remain sufficiently liquid to meet its new obligations and generate a profit.

Cramdown

The plan may be made binding on all classes of security holders, even if they all do not approve it. This is known as a cramdown. The judge may conduct a cramdown if at least one class of creditors approves the plan and the “crammed down” class is not being treated unfairly. In this context, unfairly means that no class with inferior claims in the bankruptcy hierarchy is receiving compensation without the higher-up class being paid 100% of its claims. This order of claims is known as the absolute priority rule, which states that claims must be settled in full before any junior claims can receive any compensation.

The concept of a cramdown comes from the concern by lawmakers that a small group of creditors could block the approval of a plan to the detriment of the majority of the creditors.14 By giving the court the ability to cram down a plan, the law reduces the potential for a holdout problem.

Fairness and Feasibility of the Plan

The reorganization plan must be both fair and feasible. Fairness refers to the satisfaction of claims in order of priority, as discussed in the previous section. Feasibility refers to the probability that the postconfirmation company has a reasonable chance of survival. The plan must provide for certain essential features, such as adequate working capital and a reasonable capital structure that does not contain too much debt. Projected revenues must be sufficient to adequately cover the fixed charges associated with the postconfirmation liabilities and other operating expenses.

Partial Satisfaction of Prepetition Claims

The plan will provide a new capital structure that, it is hoped, will be one that the company can adequately service. This will typically feature payment of less than the full amount that was due the claimholders.

BENEFITS OF THE CHAPTER 11 PROCESS FOR A DEBTOR

The U.S. Bankruptcy Code provides great benefits to debtors, some of which are listed in Table 12.6. The debtor is left in charge of the business and allowed to operate relatively free of close control. This has led some to be critical of what they perceive as a process that overly favors the debtor at the expense of the creditors’ interests. The law, however, seeks to rehabilitate the debtor so that it may become a viable business and a productive member of the business community.

Company Size and Chapter 11 Benefits

The fact that debtors enjoy unique benefits while operating under the protection of the bankruptcy process is clear. Smaller companies, however, may not enjoy the same benefits that the process bestows on larger counterparts.

PREPACKAGED BANKRUPTCY

A new type of bankruptcy emerged in the late 1980s. In a prepackaged bankruptcy, the firm negotiates the reorganization plan with its creditors before an actual Chapter 11 filing. Ideally, the debtor would like to have solicited and received an understanding with the creditors that the plan would be approved after the filing. In a prepackaged bankruptcy, the parties try to have the terms of the reorganization plan approved in advance. This is different from the typical Chapter 11 reorganization process, which may feature a time-consuming and expensive plan development and approval process in which the terms and conditions of the plan are agreed to only after a painstaking negotiation process.

Benefits of Prepackaged Bankruptcy

The completion of the bankruptcy process is usually dramatically shorter in a prepackaged bankruptcy than in the typical Chapter 11 process. Both time and financial resources are saved. This is of great benefit to the distressed debtor, who would prefer to conserve financial resources and spend as little time as possible in the suspended Chapter 11 state. In addition, a prepackaged bankruptcy reduces the holdout problem associated with voluntary nonbankruptcy agreements. In such agreements, the debtor often needs to receive the approval of all the creditors. This is difficult when there are many creditors, particularly many small creditors. One of the ways a voluntary agreement is accomplished is to pay all the small creditors 100% of what they are owed and pay the main creditors, who hold the bulk of the debt, an agreed-upon lower amount.

It was noted previously that approval of a Chapter 11 reorganization plan requires creditors’ approval equal to one-half in number and two-thirds in dollar amount. With the imminent threat of a Chapter 11 filing, creditors know that after the filing is made, these voting percentages, as opposed to unanimity, will apply. Therefore, if the threat of a Chapter 11 filing is real, the postbankruptcy voting threshold will become the operative one during the prepackaged negotiation process.

Prevoted versus Postvoted Prepacks

The voting approval for the prepackaged bankruptcy may take place before or after the plan is filed. In a “prevoted prepack” the results of the voting process are filed with the bankruptcy petition and reorganization plan. In a “postvoted prepack” the voting process is overseen by the bankruptcy court after the Chapter 11 filing.

Tax Advantages of Prepackaged Bankruptcy

A prepackaged bankruptcy may also provide tax benefits because net operating losses are treated differently in a workout than in a bankruptcy. For example, if a company enters into a voluntary negotiated agreement with debtholders whereby debtholders exchange their debt for equity and the original equityholders now own less than 50% of the company, the company may lose its right to claim net operating losses in its tax filings. The forfeiture of these tax-loss carryforwards may have adverse future cash flow consequences. In bankruptcy, however, if the court rules that the firm was insolvent, as defined by a negative net asset value, the right to claim loss carryforwards may be preserved.

Corporate bankruptcy is a complex process. If you are a business owner considering bankruptcy, speak to an experienced South Salt Lake Utah bankruptcy lawyer. The bankruptcy lawyer will review you case and advise you on what you need to do. There is a lot at stake in a corporate bankruptcy. Don’t take chances. Hire an experienced South Salt Lake Utah bankruptcy lawyer.

If you are a creditor and your debtor has filed a Chapter 11 bankruptcy, don’t contact the debtor directly or try to collect the debt. You will be violating the automatic stay. Instead seek an appointment with an experienced South Salt Lake Utah bankruptcy lawyer. Discuss your debt with a bankruptcy lawyer and no one else. The lawyer will advise you on what you need to do next.

South Salt Lake Utah Bankruptcy Lawyer Free Consultation

If you have a bankruptcy question, or need to file a bankruptcy case, call Ascent Law now at (801) 676-5506 for your Free Consultation. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Employers And Harassment Claims

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

South Salt Lake, Utah

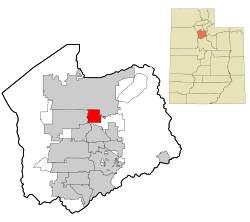

South Salt Lake is a city in Salt Lake County, Utah, United States and is part of the Salt Lake City Metropolitan Statistical Area. The population was 23,617 at the 2010 census.

[geocentric_weather id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_about id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_neighborhoods id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_thingstodo id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_busstops id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_mapembed id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_drivingdirections id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_reviews id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]