If you are purchasing a business in Ogden Utah, consult with an experienced corporate lawyer to know if the business is involved in litigation.

Of particular concern to any purchaser is whether the seller’s business is involved in litigation, either as a defendant or as a plaintiff. Similarly, a purchaser needs to know if the business is being investigated by any governmental agency, is subject to various fines or penalties, or whether it has been prohibited by the government, by court order or by agreement from engaging in any activities. In addition, the purchaser will want to probe whether the business’s operations meet all legal and regulatory requirements. A purchaser does not want to find itself investing in a company that, shortly after closing, is fined millions of dollars by a government agency, such as OSHA, or subject to a large jury verdict.

The purchaser will want to know of and review any lawsuits in which the business is involved, for obvious reasons. Not only might the business be liable for the underlying claim, but even if the claim is without merit, the business will incur costs to defend against or settle the lawsuit. The lawsuits or claims may also indicate a trend in claims of a particular nature that may be foreboding for the business or its industry.

In disclosing litigation to the purchaser, the seller may try to describe the litigation in the best possible light. It may also, either intentionally or inadvertently, fail to disclose issues that the investor may deem important. By obtaining copies of the actual pleadings and other important documents and interviewing the attorney representing the seller, the investor will be able to more accurately determine the essential facts of the case, the status of the case and the possible outcome. In addition, because the majority of litigation is eventually settled, it is important to obtain copies of all settlement agreements. Although a particular litigation matter may have been settled, the settlement agreement may require the business to do certain things or it may prohibit the business from engaging in certain activities. In fact, the terms of a settlement agreement may have a significant impact on the business’s operations. The purchaser also should obtain drafts of any proposed settlement agreements.

One of the best sources to obtain an objective summary of pending litigation is from copies of the letters sent by the business’s attorneys to the business’s independent public accountant for purposes of the audit of the business (the so-called “audit response letters”). The auditor will generally request that the attorney disclose all material “loss contingencies.” The standard of what is material will generally be agreed upon by the business and its auditor, and will be set forth in the attorney’s letter. In the letter, the attorney will provide information as to the nature of the claim, the progress to date, and the position taken by the business.

Liabilities to Officers and Directors

Officers and directors of companies often do not realize that they can be personally liable to their shareholders and to investors under a number of situations. Directors and officers owe a fiduciary duty to their corporation and to the stockholders thereof. This fiduciary duty generally involves the duty to exercise that degree of care that an ordinarily careful and prudent person would use under the circumstances.

If a company decides to go “public,” its officers and directors will be held strictly liable for any material misrepresentation or omission in the prospectus that is distributed to investors. Section 11 of the Securities Act of 1933 (the Securities Act) imposes liability for every material misrepresentation or omission in the prospectus against (1) the company offering the security, (2) the underwriters of the offering, (3) any member of the board of directors of the company at the time of the offering, (4) officers of the company who sign the registration statement (the chief executive officer, the principal financial officer, and the principal accounting officer are required by SEC rules to sign the prospectus), and (5) any expert who has prepared any segment of the registration statement and consents to being named as an expert, which will include the independent public accountants who certify the company’s financial statements. Officers and directors often do not realize that each officer signing the prospectus and each director of the company at the time of the prospectus is personally liable for the accuracy of every statement in the prospectus. Directors, and particularly outside directors, often merely skim the prospectus prior to signing it. Furthermore, because the “window of opportunity” in a stock offering is often so short, the time pressure to complete the prospectus and file it with the SEC is enormous. Thus, the liability of officers and directors is not at all commensurate with the type of due diligence often undertaken, and the liability can be astronomical.

Officers and directors are personally liable for the entire amount of the stock offering, which could wipe out the net worth of such persons. In addition, plaintiffs in these cases often add other theories of liability, such as Rule 10b-5 claims under the Securities Exchange Act of 1934 (the Exchange Act) and common law fraud, seeking further damages. Because these actions are often highly complex and usually involve conflicts among various officers and directors necessitating separate counsel, the legal costs alone in defending the claims may be staggering. Although most officers and directors have indemnification contracts with their companies, this may be of little comfort if the company is not financially able to fulfill those contracts. On top of all this, directors’ and officers’ liability insurance is becoming increasingly difficult for companies to purchase, even at extremely expensive premium.

Legal Due Diligence

Before you purchase a business, get an experienced Ogden, Utah corporate lawyer to conduct the due diligence. Most due diligence issues could conceivably be categorized under the heading “legal” because they directly relate to the compliance or non- compliance with laws. Of particular concern to any investor is whether the business is involved in litigation, and whether as a defendant or as a plaintiff. Similarly, an investor will need to know if the business is under investigation by any governmental agency, if it is subject to fines or penalties, or whether it has been prohibited by the government, by court order, or by agreement, from engaging in any activities. In addition, the investor will want to probe whether the business’s operations meet all legal and regulatory requirements.

An investor does not want to invest in a company that, shortly after closing, will be fined millions of dollars by a government agency, such as OSHA, or subject to a large jury verdict. In fashioning legal questions, the investor will find helpful the assistance of an attorney to ensure that all aspects of the business’s operations are adequately investigated. As with other due diligence questions, legal questions should be coordinated with the representations and warranties in the transaction document. In addition, although these questions may be termed “legal” in nature, the investor’s financial and operational people, as well as his lawyers, should carefully review the results.

At the heart of the legal due diligence is a review of pending or prospective litigation. The investor will want to review any lawsuits involving the business. Not only might the business be liable for the underlying claim, but even if the claim is without merit, the business will incur litigation costs. The lawsuits or claims may also indicate a foreboding trend in the business or its industry. The investor should, at a minimum, request the name of the case; the court where the suit is filed; a description of the general nature of the case; the amount sought; the status of the case; and the likely outcome.

If a business’s shareholders think an officer or director has breached his or her fiduciary duty to the business by such acts as misappropriating funds or not using care in managing the business, they may bring a shareholder derivative suit. In a derivative action, the shareholder or shareholders sue on behalf of and for the benefit of the business. It is important for the investor to know of any shareholder derivative suits and if there is any basis for a claim that the directors or officers have acted inappropriately or have not acted in the best interest of the shareholders. If the shareholders’ claim is successful, the corporation will be required to reimburse them for litigation expenses incurred in the lawsuit. Because shareholder derivative suits are often hotly contested, the expenses may be significant. Any lawsuit will likely divert the attention of the officers and directors away from the proper management of the business.

If the business is involved in manufacturing, licensing, selling or renting products, a chief concern to the investor will be the possibility of any claims or suits based upon the products being defective. The investor will want to know what type of warranties exist, the claims’ history and amount spent annually on warranty claims. It is also extremely important for the investor to know if there are any pending claims against the business for personal injury or for property damages based upon a defective product and the claims history for any such lawsuits. The type of insurance the business maintains to cover such claims and its adequacy should be reviewed simultaneously.

There are both civil and criminal issues relating to benefits either being given by the business (usually by an employee of the business) or being received by the business or its employees. First of all, if such benefits are being given or received, they may be illegal and may subject the business to criminal or civil fines or penalties. For instance, a business may be subject to criminal liability under the Foreign Corrupt Practices Act if it pays anything of value to influence the decisions of foreign officials. The Robinson- Patman Act and various state “commercial bribery” laws prohibit the payment of commissions to another unless that party actually renders services for the payment. These statutes are designed to stop commercial bribery, such as an officer of a company receiving a kickback without the knowledge of the company. In addition to being illegal, the investor needs to know whether, if the benefit is stopped, the business might be adversely affected. For example, the business may have lucrative contracts dependent upon someone receiving money “under the table” and if revealed, the other party would be inclined to fire its employee and terminate the contracts.

Price-fixing generally involves agreements either among competitors or persons in the chain of distribution, such as wholesalers and retailers, to fix product prices. Price-fixing done to either raise, depress, or stabilize prices is generally anti-competitive and illegal under federal and state anti- trust laws.

The term “market splitting” refers to other types of anti-competitive schemes in which businesses with a substantial market share of an industry agree to drive out lesser competitors. “Kickbacks” and “payoffs” refer to activities that may be illegal either under the Robinson-Patman Act or under state commercial bribery laws. If the business is in the health care industry and is a provider to persons receiving Medicare, it is prohibited from providing kickbacks to persons who are in a position to refer Medicare patients.

It is important for the investor to know if the business has engaged or been suspected of any of these schemes and if it has been investigated by the Federal Trade Commission, any state attorney general’s office, or any other governmental entity.

Although a business may not admit to price-fixing, bid-rigging, and the like, if it is in an industry where such activities are commonplace, it is probably difficult for the business not to engage in such acts. Starting with this industry information, the investor should ask how the business competes and survives without engaging in these activities. The responses may be so revealing the investor will decide not to invest.

Having an experienced Ogden Utah corporate lawyer conduct the due diligence before you buy an existing business can save you from trouble later.

Business Lawyer Ogden Utah Free Consultation

When you need legal help with a corporation, LLC, or business in Ogden Utah, please call Ascent Law for your free consultation (801) 676-5506. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Is It Better To File Chapter 13 Or 7 Bankruptcy?

Imputing Income For Divorce In Utah

Will A Chapter 13 Plan Look Better On My Credit Report Than Chapter 7?

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

Ogden, Utah

|

Ogden, Utah

|

|

|---|---|

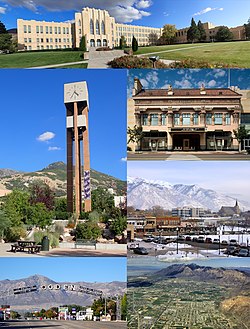

From top left to bottom right: Ogden High School, Weber State University Bell Tower, Peery’s Egyptian Theater, Downtown, Gantry Sign, aerial view

|

|

| Nickname:

Junction City

|

|

| Motto:

Still Untamed

|

|

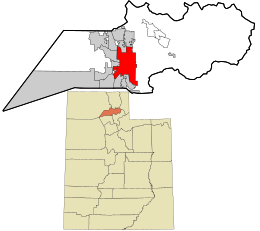

Location in Weber County and the state of Utah

|

|

| Coordinates: 41°13′40″N 111°57′40″WCoordinates: 41°13′40″N 111°57′40″W | |

| Country | United States |

| State | Utah |

| County | Weber |

| Settled | 1844 |

| Incorporated | February 6, 1851 (As Brownsville) |

| Named for | Peter Skene Ogden[1] |

| Government

|

|

| • Type | Council-Mayor |

| • Mayor | Mike Caldwell |

| Area | |

| • Total | 27.55 sq mi (71.35 km2) |

| • Land | 27.55 sq mi (71.35 km2) |

| • Water | 0.00 sq mi (0.01 km2) |

| Elevation

|

4,300 ft (1,310 m) |

| Population

(2020)

|

|

| • Total | 87,321 |

| • Density | 3,169.55/sq mi (1,223.84/km2) |

| Demonym | Ogdenite [3] |

| Time zone | UTC−7 (MST) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP Codes |

84201, 84244, 844xx

|

| Area codes | 385, 801 |

| FIPS code | 49-55980[4] |

| GNIS feature ID | 1444049[5] |

| Website | http://ogdencity.com/ |

Ogden /ˈɒɡdən/ is a city in and the county seat of Weber County,[6] Utah, United States, approximately 10 miles (16 km) east of the Great Salt Lake and 40 miles (64 km) north of Salt Lake City. The population was 87,321 in 2020, according to the US Census Bureau, making it Utah’s eighth largest city.[7] The city served as a major railway hub through much of its history,[8] and still handles a great deal of freight rail traffic which makes it a convenient location for manufacturing and commerce. Ogden is also known for its many historic buildings, proximity to the Wasatch Mountains, and as the location of Weber State University.

Ogden is a principal city of the Ogden–Clearfield, Utah Metropolitan Statistical Area (MSA), which includes all of Weber, Morgan, Davis, and Box Elder counties. The 2010 Census placed the Metro population at 597,159.[9] In 2010, Forbes rated the Ogden-Clearfield MSA as the 6th best place to raise a family.[10] Ogden has had a sister city relationship to Hof in Germany since 1954. The current mayor is Mike Caldwell.

[geocentric_weather id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_about id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_neighborhoods id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_thingstodo id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_busstops id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_mapembed id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_drivingdirections id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_reviews id=”795a0e26-23bc-470c-a334-135af97269ac”]