An experienced South Jordan foreclosure lawyer can review you case and advise you on your options. You could be a victim of mortgage fraud and an experienced South Jordan foreclosure lawyer can help you fight foreclosure.

Starting in the 1980s, financial institutions began lending credit to subpar creditworthy borrowers, but it was not until the early mid 1990s that subprime lending began to expand at an exponential rate. While many factors contributed to the growth of subprime lending, more than any other reason for the growth was Wall Street investors’ growing interest in subprime securities backed by loans from U.S. homeowners. Considered by many to be one of the greatest innovations in mortgage lending, the securitization of mortgages into mortgage backed securities dramatically changed the mortgage lending industry. Rather than one single bank supplying the money to fund a mortgage, securitization made it possible for multiple investors to fund mortgages. The banks simply supplied access to credit (mortgages, consumer loans, and auto loans), then sold the assets to investors through the securitization markets, allowing them to replenish their cash reserves. Over time, traditional financial institutions such as retail banks became loan originators.

Wall Street’s involvement in subprime lending through the secondary market changed the face of the primary lending industry in several ways. First, the underwriting standards deteriorated as financial institutions no longer had a stake in the loans they originated. As long as the loans originated by mortgage lenders fell within the guidelines set forth by their investors, they were considered good loans. The banks made money from fees they charged the investors for originating, underwriting, and funding the loan. Second, Wall Street’s involvement led to the growing number of mortgage brokers in the industry. The share of mortgage originations by brokers compared to banks also increased.

If a borrower wanted a refinance but did not have sufficient income, they would rely on their broker to get them qualified. The only thing that matters to most borrowers is getting the loan, and they depend on the loan agent to qualify them. It is important to note that the majority of the mortgage transactions during the last decade were refinances, where borrowers wanted to obtain cash from the equity of their homes. This was especially fueled by the year after year appreciation of the housing prices and low interest rates. The initial loan application or Uniform Residential Loan Application signed by the borrower/s contains detailed financial information of the borrower/s. In other words, it was described that borrowers are well aware that their income and/or asset is inflated on the loan application. The important question among various loan originators is how much money is required to get a particular client approved. Loan originators (brokers, processors, and loan officers) have the experience and knowledge necessary to determine the exact requirements of lenders and tailor the loan application and required documents to meet qualification requirements. Since everyone in this transaction benefited (the borrower gets the loan and the remaining parties (loan officer, broker, and lender makes a profit), it is easy to not see a victim. It wasn’t until the housing crash that countless victims of fraud became apparent.

Borrowers and their loan agents share the same goal, which is to obtain a mortgage successfully. Lenders (e.g., underwriters, account managers, and representatives) commonly ignore questionable financial claims or documentations submitted by brokers if the information seems reasonable. A broker may be approved with 30 different lenders, but will primarily use only a handful of lenders who are “willing to work with them.” Alternative mortgage products and low underwriting standards created conditions ripe for crime in legal institutions that might perceive blatant intentional misrepresentations, misstatements, and omissions as nothing more than creative or risky financing.

Alternative mortgage products, such as the popular low doc or no doc loans, commonly known in the industry as stated loans or liar loans, require crafty manipulation on the part of loan agents to qualify borrowers who do not meet lender requirements. The thin line between creative financing and outright criminal fraud is commonly crossed by loan agents who perceive their actions as acceptable in the industry. This is evidenced by many lenders’ circumvention of their responsibilities to thoroughly underwrite a loan when a stated loan is involved. There are various ways to get a client to qualify for a loan – many of which may be creative and led to fraud. For example, a loan agent may claim that funds from a refinance will be used to pay existing debts, and therefore reduce the client’s debt-to-income ratio of the loan. However, once a loan funds, a loan agent may instruct the escrow officer, whom he has an established relationship with, to not pay off the debts and establish falsified payoffs. Another example of the thin line between creative financing and criminality is the line between amounts that is inputted as income on a stated or a liar loan. Many loan agents in the industry presume that they can state any income amount on a loan application, as long as it “makes sense.” As such, loan agents will approach a stated loan by first determining the amount required to qualify and then figuring out ways to make sense of it to the lender. This often involves misrepresentations, falsifications, and fraud. Instead, loan agents should first determine their client’s income and present it to the lender in an honest and truthful manner.

When such practices are condoned within the working environment, and even promoted by their clients, colleagues, and superiors, questions of ethics and legality are easily suppressed.

No or low documentation loans, or stated loans, do not mean state whatever is realistic and whatever the lender will accept. Loan agents are bound by professionalism, ethical conduct, and fiduciary duties to their client to practice responsible financing. In this case, the client should have been instructed by the broker to reduce the loan amount to better suit his or her ability to repay. Whether the loan agent rationalized the act as accepted. within the organizational structure by colleagues or superiors, misrepresentations, such as overstating income or assets, was a crime. The borrowers obtained the home or credit they desired; loan practitioners profited from their tractions; and lenders, along with their investors, got their loans.

In the mortgage industry, the manipulation of borrower information in order to meet the qualifications of a mortgage loan is the most common type of fraud. Most of the time, the acts are very simple in nature and include adjustments to the financial information that the loan agent (a superficial term that applies to all official parties involved in the loan origination process) submits on behalf of the borrower. This may include adjusting income to fit the minimum requirements of the lender, despite being aware that the income is false, or having the appraiser inflate the value of the property, although industry practitioners, brokers, loan officers, and processors, are well aware of lending guidelines and requirements. More importantly, loan originators know exactly what will fly or pass with lenders. For instance, loan agents are well aware of actions that may raise eyebrows and may manipulate information accordingly. A stated income loan application submitted on behalf of a custodian claiming an annual salary of $I00K would raise suspicion. Therefore, to avoid suspicion, loan agents simply manipulate the employment title and income such as changing custodian to senior waste/recycling management officer and restating the income as $80–90K, annually. To compensate for the additional required income, the loan agent may simply create an additional income source by fabricating a fictitious job, such as a part-time home office income source.

Data fabrication involves the creation of false documentation in order to establish source(s) of income and assets. This type of fraud includes creating financial documents, such as W2’s, Verification of Deposits (VOD), Verification of Rent (VOR), or Certified Public Accountant (CPA) letters. Under many circumstances, the loan agent will establish bank statements from an existing account or create false rental income (VOD) from a home the borrower supposedly owns. Another example of this type of fraud includes generating a Letter of Explanation (LOE) to explain information submitted to lenders.

• The general or common process that borrowers go through to get a loan is described below. It is important to note that the following description is generic and not the experiences of all borrowers.

• Loan agents inform their borrower they can get the loan, but it will require that their income and/or assets be stated as a particular amount.

• Borrowers are informed that they qualify or not. If they do not qualify, they are either turned away (unlikely) or explained that certain actions will be necessary by either the loan agent or the borrower to get them “qualified.” For example, if borrowers lack the required assets, they are advised to have a friend or family member deposit a specified amount of funds into the bank and leave it for 2 months, or the loan agent has to establish a false verification of deposit (VOD).

It is common for borrowers to be unaware of the fraudulent acts committed by their loan agents. In certain circumstances, loan agents will not inform their borrower of the disqualifier(s) and questionable act(s) made by the loan agent. This occurs when the disqualifier and the corresponding act to get the loan approved is considered minor.

In most circumstances, loan originators are completely knowledgeable about the accuracy and credibility of the information they submit on behalf of their clients. There are cases where borrowers intentionally submit falsified information to their loan agents to misrepresent both their agent and their lender; however, fraud for profit, as defined in the industry and by the FBI, is uncommon. Loan agents and borrowers both stipulate that it is in their interest to be fully informed of anything important in a loan. Borrowers are required to sign and approve loan applications and documents and loan originators commonly express the importance of being straightforward and honest with their clients. Honesty between loan originators and their clients is good for business. Further, inconsistency of information by either party can raise red flags to a lender and result in a denial of a loan.

The job of the broker office is to gather the required information for a loan application and submit it to the lender on behalf of the borrower. Thus, crimes involving intentional misrepresentation and misstatement are much more common in the broker’s office. Lenders, on the other hand, are responsible for underwriting the application materials in accordance with the law and guidelines set by their investors. A major part of the duties and responsibilities of lenders include looking over application documents and verifying the information. It was not surprising that intentional oversight or acts of concerted ignorance were described as the most common forms of mortgage fraud among employees of financial lenders.

Once the loan file has been submitted to a prospective lender, it is overseen by an account manager or an underwriter. These loan agents are critical to the successful outcome or funding of a loan. Account managers and underwriters account for the majority of work involved in the origination process of the lending phase. Their duties and responsibilities include establishing loan approval conditions and ensuring that prospective loans adhere to lending guidelines. Account managers and underwriters work directly with their brokers, loan officers, and processors on a regular basis, and commonly coach them in structuring a loan or document to make the loan work. They are extremely knowledgeable about their employers’ guidelines and requirements, which makes them a valuable asset to brokers.

More importantly, account managers and underwriters are responsible for approving loan conditions once they have verified the information. For example, a loan approval may be predicated on verification of conditions such as an applicant’s employment and assets. It is common for these loan agents to overlook questionable information or sign off a condition(s) without verification.

Funders and appraisal reviewers also commonly overlook questionable information, such as an appraisal that lacks the required comparisons to justify the value of the property in question.

Having an appraiser willing to work with you is extremely important to a mortgage brokerage office. Most loan transactions are predicated on the value of the property. Appraisers who are conservative valuators can have a difficult time finding business, taking a conservative approach can be disastrous for an appraiser’s career. During the real estate boom, it was simple to justify appraisal values that exceeded the actual value of a property. For example, appraisers could avoid taking pictures that showed damage to the property, or use nearby properties with greater appreciation as comparables. If a garage were converted into a bedroom without a permit, the appraiser would include only an outside picture of the garage. Another common method with which appraisers inflate values is using comps, or comparables, that do not accurately reflect the value of the target property.

Victims of mortgage fraud are often subject to foreclosure for no fault of theirs. If you are a victim of mortgage fraud and facing foreclosure, speak to an experienced South Jordan Utah foreclosure lawyer.

South Jordan Utah Foreclosure Attorney Free Consultation

When you need legal help with a foreclosure in South Jordan Utah, please call Ascent Law LLC for your free consultation (801) 676-5506. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

South Jordan, Utah

|

South Jordan, Utah

|

|

|---|---|

South Jordan City Hall, March 2006

|

|

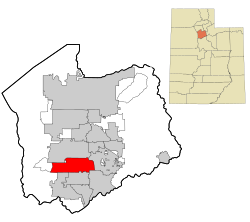

Location in Salt Lake County and the state of Utah.

|

|

| Coordinates: 40°33′42″N 111°57′39″WCoordinates: 40°33′42″N 111°57′39″W | |

| Country | |

| State | |

| County | Salt Lake |

| Established | 1859 |

| Incorporated | November 8, 1935[1] |

| Named for | Jordan River |

| Government

|

|

| • Type | council–manager |

| • Mayor | Dawn Ramsey |

| • Manager | Gary L. Whatcott |

| Area | |

| • Total | 22.31 sq mi (57.77 km2) |

| • Land | 22.22 sq mi (57.54 km2) |

| • Water | 0.09 sq mi (0.23 km2) |

| Elevation

|

4,439 ft (1,353 m) |

| Population | |

| • Total | 77,487 |

| • Density | 3,452.07/sq mi (1,332.86/km2) |

| Time zone | UTC−7 (Mountain (MST)) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP code |

84009, 84095

|

| Area code(s) | 385, 801 |

| FIPS code | 70850 |

| GNIS feature ID | 1432728[4] |

| Website | www |

South Jordan is a city in south central Salt Lake County, Utah, United States, 18 miles (29 km) south of Salt Lake City. Part of the Salt Lake City metropolitan area, the city lies in the Salt Lake Valley along the banks of the Jordan River between the 10,000-foot (3,000 m) Oquirrh Mountains and the 11,000-foot (3,400 m) Wasatch Mountains. The city has 3.5 miles (5.6 km) of the Jordan River Parkway that contains fishing ponds, trails, parks, and natural habitats. The Salt Lake County fair grounds and equestrian park, 67-acre (27 ha) Oquirrh Lake, and 37 public parks are located inside the city. As of 2020, there were 77,487 people in South Jordan.

Founded in 1859 by Mormon settlers and historically an agrarian town, South Jordan has become a rapidly growing bedroom community of Salt Lake City. Kennecott Land, a land development company, has recently begun construction on the master-planned Daybreak Community for the entire western half of South Jordan, potentially doubling South Jordan’s population. South Jordan was the first municipality in the world to have two temples of The Church of Jesus Christ of Latter-day Saints (Jordan River Utah Temple and Oquirrh Mountain Utah Temple), it now shares that distinction with Provo, Utah. The city has two TRAX light rail stops, as well as one commuter rail stop on the FrontRunner.

[geocentric_weather id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_about id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_neighborhoods id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_thingstodo id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_busstops id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_mapembed id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_drivingdirections id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_reviews id=”9d240370-0efd-4320-8bd2-de15226eaa86″]