Contact an experienced Alpine Utah real estate lawyer if you are buying real estate for development. A real estate buyer has to anticipate having to secure one or more acquisition loans in order to buy a property and one or more construction loans in order to build or rehabilitate improvements on the property.

Generally, acquisition and construction loans are short-term loans that mature or must be paid back in 12 to 18 months. One lender may provide the sponsor with funds to complete both acquisition and construction, or these loans may be secured from two different lenders. In practice, the sponsor may have difficulty attracting a construction lender if an acquisition lender is already in the deal because of the prior lien position held by the acquisition lender. The construction lender would lend to the sponsor and would be secured by the property; however, because the acquisition lender lent its money and filed its claim against the property first, it would get paid in full before the construction lender received anything in the event of a foreclosure sale. This problem may be avoided if the acquisition lender is willing to share its priority position with the construction lender. You will have to secure one or more permanent loans in order to pay off or “take out” the acquisition and construction loans.

Settlement Process

When all of the pre-purchase considerations and steps have been completed and the purchaser is ready to go forward with the purchase of the property itself, a whole new set of issues and concerns arises. The settlement process, in a nutshell, involves payment by the purchaser of the acquisition price, signing of the deed of conveyance of the property by the seller, and recording of that deed among the land records of the jurisdiction in which the property is located.

The first step is to understand the role of the settlement agent. The settlement agent acts as the neutral “referee” of the settlement. The settlement agent does not represent any of the parties at the settlement, but instead carries out the instructions of all the parties—the purchaser, the seller, the lender (if any), and the local government.

The main reason that a settlement agent is needed is because it is virtually impossible to carry out the fundamental aspect of a sale directly between purchaser and seller without a level of trust that is not justified by normal market considerations. The seller has to sign the deed conveying the property to the purchaser; the seller does so in exchange for payment of the purchase price. The purchaser has to pay the purchase price, but only when the purchaser can be assured that the seller does indeed have good and marketable title to convey to the purchaser. Without the involvement of the neutral settlement agent, the seller could not be assured that the purchaser was providing all of the required acquisition price (including all funds being provided by third-party lenders or investors). Similarly, the purchaser and the purchaser’s lenders and investors could not be assured that their acquisition funds were being used to acquire a deed to a property that the seller has the authority to convey. The settlement agent holds in escrow the deed and the acquisition funds from all relevant sources until the settlement agent can successfully record the deed and ensure that no unidentified claims have been recorded against the property.

Even though the settlement agent plays a neutral role, in many jurisdictions the settlement agent wears more than one hat by representing one of the parties—the purchaser, seller, or lender. Whether the settlement agent may play multiple roles largely depends on what the local custom and practice permit. Where multiple roles are permitted, the reasoning is that if a conflict does arise between the neutral role and the representative role, the title insurance company can resolve the dispute by making the decision from a neutral perspective. Title insurance and the role of the title insurance company is discussed in the following sections.

Title Insurance

The second step is understanding title insurance. At acquisition settlement, the purchaser obtains an owner’s title insurance policy and the lender obtains a lender’s or mortgagee’s title insurance policy. Generally, both policies are paid for by the purchaser. The title insurance policies ensure the purchaser and the lender that the seller had good and marketable title to the property, that all required actions to transfer the property to the purchaser were accomplished in accordance with local law, and that no private or public party has any claim against the property. In addition, the lender’s policy ensures that the lender has a valid security interest, which has priority over all liens except those specifically noted as exceptions.

If any private or any public party makes any such claim at any time in the future, the title insurance policy will protect the purchaser and/or the

The main reason that a settlement agent is needed is because it is virtually impossible to carry out the fundamental aspect of a sale directly between purchaser and seller without a level of trust that is not justified by normal market considerations. The seller has to sign the deed conveying the property to the purchaser; the seller does so in exchange for payment of the purchase price. The purchaser has to pay the purchase price, but only when the purchaser can be assured that the seller does indeed have good and marketable title to convey to the purchaser. Without the involvement of the neutral settlement agent, the seller could not be assured that the purchaser was providing all of the required acquisition price (including all funds being provided by third-party lenders or investors). Similarly, the purchaser and the purchaser’s lenders and investors could not be assured that their acquisition funds were being used to acquire a deed to a property that the seller has the authority to convey. The settlement agent holds in escrow the deed and the acquisition funds from all relevant sources until the settlement agent can successfully record the deed and ensure that no unidentified claims have been recorded against the property.

Even though the settlement agent plays a neutral role, in many jurisdictions the settlement agent wears more than one hat by representing one of the parties—the purchaser, seller, or lender. Whether the settlement agent may play multiple roles largely depends on what the local custom and practice permit. Where multiple roles are permitted, the reasoning is that if a conflict does arise between the neutral role and the representative role, the title insurance company can resolve the dispute by making the decision from a neutral perspective.

Lawyer as settlement agent

An experienced Alpine Utah real estate lawyer may be a preferable option, for a variety of reasons. Before discussing those reasons, it is necessary to understand that the lawyer will have an agent relationship with the title insurance company. That is, subject to the limitations in the agency agreement, the law firm or settlement company will have the authority to determine whether to issue a title insurance policy and to actually issue it on behalf of the title insurance company.

The title insurance company will have the ultimate liability to pay for any claims, but the title insurance company and the settlement agent will share the title insurance premium. Both the title insurance company and the law firm or settlement company profit from this relationship. The title insurance company obtains business it might not otherwise have, and the settlement agent is able to provide a service and collect fees it would not realize without the agency relationship with the title insurance company.

The reasons why a purchaser might be better served by selecting a law firm or a settlement company rather than a title company are varied. First and most important, the purchaser may have an established relationship with a law firm or settlement company. That established relationship may include a fundamental level of trust, which alone would outweigh any reason to consider selecting any other settlement agent. This level of trust may have been developed during the prepurchase phase of the process or from settlements in earlier purchases.

Last but not least, a purchaser should look for a settlement agent that will discount settlement charges. The settlement and title insurance business is very competitive in most jurisdictions; the purchaser should shop around for the least expensive charges. Most charges for a settlement are within the discretion of the settlement agent to discount. Those costs include the settlement fee or settlement attorney fee, the title report fee, the title examination or underwriting fee, the title insurance binder or commitment fee, the document preparation fee, and the notary fee. Each settlement agent chooses from these different fees, and perhaps other similar fees, and charges only some of them. The purchaser, when shopping for the lowest cost, must ask the correct questions; that is, the settlement agent should be asked to list each and every settlement cost, however it is denominated. A settlement agent may say that the settlement fee is only $100, compared to a $250 settlement fee quoted by a competing settlement agent; however, the second agent may be less expensive because the first agent charges an additional $250 in other charges and the second one does not charge any of the added-on fees.

The largest single cost from most settlement agents is the one-time premium for the title insurance. Normally, the title insurance rates are set by the title insurance company, and the settlement agent must charge what the company requires.

Even without negotiating a special discount, most title companies offer discounts called reissue or substitution loan discounts. These discounts range from 20 percent to 60 percent or more. They are available where the same property and either the borrower or the lender (or both) is involved in the subsequent transaction. For example, a title company might offer a 60 percent discount for the title insurance policy for a permanent loan if that same title company previously had insured the construction loan for the same property.

Preparing for Settlement

This step involves providing all information requested by the settlement agent and the lender in order to produce all documents necessary to complete the settlement. Typically, the lender or lender’s counsel will compile a checklist of standard loan materials that the borrower must provide prior to settlement. The settlement agent will identify materials needed for settlement.

Title Insurance Commitment

Prior to settlement, the title insurance company, either directly or through the settlement agent, orders or conducts a title report showing the existing owner and any claims against the property and issues a title insurance commitment (also known as a binder or a pro forma policy). The commitment states the requirements that must be met before a policy can be issued to insure the proposed owner and the proposed lender(s).

The requirements always include recording of a deed vesting title in the proposed owner, and payment of all property taxes and water and sewer fees. They also include removal of all existing liens or encumbrances, such as existing deeds of trust or mortgages, judgment liens, covenants, rights of way, and easements.

Alternatively, any of the liens or other encumbrances may remain of record and not be removed if the purchaser and the purchaser’s lender(s) agree. In that event, the title insurance policy specifically will take an exception to the effect of the named liens or encumbrances.

Property Location Survey

The purchaser will need to order a property location survey that shows the property’s boundaries and where any buildings are located within the property lines. The lender will determine how detailed the survey needs to be. The more detailed it is the higher the cost will be. The ALTA/ACSM survey is normally the most expensive. The settlement agent can recommend a surveyor with which the settlement agent works.

Hire the services of an Alpine Utah Real Estate Attorney

There are many things that need to be considered when purchasing real estate. It’s not an easy process. There are many laws and regulations that have to be taken into account. After you buy the property as the owner you are legally responsible for the property. That’s why proper due diligence must be done before you conclude the deal. If you are planning to purchase real estate in Utah, speak to an experienced Alpine Utah real estate lawyer. The lawyer can guide you with the purchase process.

Alpine Utah Real Estate Lawyer Free Consultation

When you need legal help with a real estate matter in Alpine Utah, please call Ascent Law for your free consultation (801) 676-5506. We want to help you!

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Are Divorce Fees Tax Deductible?

Difference Between A Divorce And Annulment

10 Ways Your Spouse Can Hide Money In Divorce

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

Alpine, Utah

|

This article needs additional citations for verification. (April 2008)

|

|

Alpine, Utah

|

|

|---|---|

Overlooking Alpine

|

|

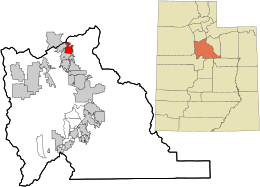

Location in Utah County and the state of Utah

|

|

| Coordinates: 40°27′23″N 111°46′25″WCoordinates: 40°27′23″N 111°46′25″W[1] | |

| Country | United States |

| State | Utah |

| County | Utah |

| Settled | 1850 |

| Incorporated | January 19, 1855 |

| Area | |

| • Total | 7.96 sq mi (20.60 km2) |

| • Land | 7.96 sq mi (20.60 km2) |

| • Water | 0.00 sq mi (0.00 km2) |

| Elevation

|

4,951 ft (1,509 m) |

| Population

(2020)

|

|

| • Total | 10,251 |

| • Density | 1,319.67/sq mi (509.55/km2) |

| Time zone | UTC-7 (MST) |

| • Summer (DST) | UTC-6 (MDT) |

| ZIP code |

84004

|

| Area codes | 385, 801 |

| FIPS code | 49-00540[3] |

| GNIS feature ID | 1438174[4] |

| Website | City of Alpine |

Alpine is a city on the northeastern edge of Utah County, Utah. The population was 10,251 at the time of the 2020 census. Alpine has been one of the many quickly-growing cities of Utah since the 1970s, especially in the 1990s. This city is thirty-two miles southeast of Salt Lake City. It is located on the slopes of the Wasatch Range north of Highland and American Fork. The west side of the city runs above the Wasatch Fault.[5]

[geocentric_weather id=”fe576a96-1511-46ab-80ed-a9d39268d279″]

[geocentric_about id=”fe576a96-1511-46ab-80ed-a9d39268d279″]

[geocentric_neighborhoods id=”fe576a96-1511-46ab-80ed-a9d39268d279″]

[geocentric_thingstodo id=”fe576a96-1511-46ab-80ed-a9d39268d279″]

[geocentric_busstops id=”fe576a96-1511-46ab-80ed-a9d39268d279″]

[geocentric_mapembed id=”fe576a96-1511-46ab-80ed-a9d39268d279″]

[geocentric_drivingdirections id=”fe576a96-1511-46ab-80ed-a9d39268d279″]

[geocentric_reviews id=”fe576a96-1511-46ab-80ed-a9d39268d279″]