According to the American Heritage Dictionary, bankruptcy is a voluntary petition where you are judged to be legally insolvent. This basically means that you lack the money to pay your debts. People file for protection under bankruptcy laws for a number of reasons. Some of the more common include credit card debt, job loss, medical bills, divorce or bad financial management.

Bankruptcy may be your choice or forced upon you by creditors. It can cause debts to either be eliminated or repaid under the direction of the bankruptcy court. If you are considering bankruptcy filing, consult with an experienced South Jordan Utah bankruptcy lawyer.

For individuals, there are two basic types of bankruptcy: Chapter 7 and Chapter 13. Those designations refer to their particular chapters within Title 11 of the United States Code.

Chapter 7 is often referred to as liquidation because it allows certain debts to be eliminated. In some cases, property may be sold to pay down debts. But some states prohibit the selling of certain assets such as cars and houses for Chapter 7 bankruptcy purposes. In states where cars are not exempt, they can be repossessed, but the consumer has the right to continue making the payments.

It’s important to understand that bankruptcy doesn’t wipe away all debts. Items such as child support, tax obligations and student loans are typically not forgiven.

Chapter 13 is referred to as reorganization. This type of bankruptcy allows filers the chance to repay debts by adjusting loan terms. If you have a debt such as a mortgage payment, Chapter 13 gives you the option of catching up on missed payments by spreading the debt out over a longer period of time. The length of repayment depends on the amount owed.

In October 2005, a new law was established to require individuals to receive a certificate from a credit counselor before filing for bankruptcy. The purpose of this is to make sure consumers have no other way to pay back the funds before taking such a drastic step as filing for bankruptcy, and to ensure they have learned how to budget and manage their expenses so they aren’t repeat filers.

Credit counselors must be approved by the U.S. Trustee Program, which oversees the bankruptcy courts in the United States. Consumers receive counseling on budgeting before and after filing.

There are changes to Chapter 7 bankruptcy, too. It’s no longer an automatic way to eliminate debts. First, the law exempts certain living expenses like food and rent/mortgage payments from a formula to determine whether a consumer can afford to pay a portion of unsecured debt like credit card bills.

Next, your income will be compared to the state median. If it exceeds that amount, you will not be allowed to file a liquidation bankruptcy. This is to ensure that consumers who can afford to repay a portion of their debts do so through a Chapter 13 bankruptcy rather than totally walking away from what they owe.

One last note on the changes is the increase in attorney’s fees. The new laws require that more data be obtained, and lawyers are required to vouch that the information submitted to the courts is accurate. Therefore, lawyers’ fees may become higher. If it is discovered that information the lawyer reported to the bankruptcy court is false, legal action can be taken against you and your lawyer.

The purpose of the laws is to promote good financial management skills. Many people have not been taught how to properly manage their personal finances, and the government’s hope is that good credit counseling will get folks back on the right track and help them avoid filing for bankruptcy again in the future.

Keep in mind, bankruptcies can remain on a credit report up to 10 years. This can make it difficult to obtain credit in the future. As I mentioned earlier, you can contact creditors directly if you are unable to make payments on time, and you can set up a repayment schedule without going to credit counselors or filing for bankruptcy.

Bankruptcy Or Wage Garnishment

The Internal Revenue Service (IRS) uses many methods to collect tax debts. Wage garnishment is a common method used by the IRS. If you owe tax debts to the IRS and you are a salaried employee, the IRS is most likely to garnish your wage in an attempt to recover the tax dues.

When IRS garnishes your wage, your employer has to give a part of your wage directly to the IRS before paying you. The IRS will let you keep a portion of your wage to meet your basic expenses. The wages garnishment will continue until the IRS has collected enough money to clear your tax debt.

Garnishment Procedures

The IRS will not garnish your wage all of a sudden. You will get enough notice to know that it is coming. You will first receive a notice of past tax dues. You will have 10 to 30 days to clear the dues depending on the type of tax owed. If you do not pay the tax dues or reach a compromise with the IRS, you will receive a “Final Notice of Intent to Levy”. You will also receive a notice informing you of your rights. If you do not pay up within 30 days from the date of the notice, the IRS will take steps to garnish your wages.

Preventing Garnishments

If you receive a notice from the IRS informing you about their intention to levy your wage to collect tax debts, consult with an experienced South Jordan Utah bankruptcy lawyer. The attorney can help you prevent a wage garnishment. The attorney can contact the IRS on your behalf and negotiate with the IRS for a settlement. You can settle your tax debts with the IRS but you must negotiate in good faith. You must contact the IRS within the time period specified in the IRS notice. When you are staring at the prospect of a wage garnishment you will most likely be under a lot of stress. You should therefore leave the task of negotiating with the IRS to your attorney. The attorney will know the rules for settling a tax debt. If you enter into an offer in compromise or an installment agreement with the IRS, the IRS will not levy your wage. Also if you file an appeal against the decision to garnish your wages within the appeal period, the IRS will not garnish your wages until the appeal is decided.

Getting Legal Help

You can stop a wage garnishment by filing for bankruptcy protection. You can discharge your tax debts in bankruptcy and the automatic stay will prevent the IRS from taking further steps. However this will apply only in case of income tax. You must have filed a return for the tax year in question and the return must have been filed at least two years prior to your bankruptcy filing. Speak to an experienced South Jordan Utah bankruptcy lawyer to know how you can prevent garnishment by filing for bankruptcy.

Chapter 13 Bankruptcy Lawyer

A Chapter 13 bankruptcy is essentially the repayment of the debts according to the terms of a repayment plan. The debtor continues to retain all of his or her assets unlike a Chapter 7 where all of the debtor’s non-exempt assets are sold by the trustee to repay the creditors. The benefit to the debtor is that most of his assets are protected under Chapter 13.

Repayment Plan Lawyer

The objective of a Chapter 13 is reorganization. This is different from a Chapter 7 bankruptcy where the main objective is liquidation. Chapter 13 is for debtors having a regular source of income who can repay their creditors over period of time under a repayment plan. Since the debtor will be making the payments under the plan (generally 3 to 5 years in duration), there isn’t much incentive to liquidate the debtor’s assets.

A Chapter 13 debtor continue to retain possession and control of his or her assets subject to certain exceptions. The value of the debtor’s assets will determine which of the assets are considered exempt under bankruptcy laws and also for determining the payment schedule under the repayment plan. The value of the non-exempt assets of the debtor is used as a base line. For example if the value of the debtor’s non-exempt assets is X dollars, then the minimum repayment the debtor must offer under the repayment plan will be X dollars. If you are considering filing for bankruptcy, please check with your state law. In such states you can choose between federal and state exemptions which allows you to opt for the one that offers you the maximum benefit.

Exempt Property In Bankruptcy

Both federal and state bankruptcy laws provide for exempt properties. In some states, the debtor can choose between the two. Generally there is a cap on the value of certain exempt property. Generally the following properties subject to ceiling in some cases are considered exempt:

• automobiles;

• debtor’s primary residence

• personal items

• household items and furniture; and

• jewelry.

Depending on your circumstances, there may be certain assets which you can claim as exempt when you file a bankruptcy petition. This can depend on many factors including your applicable state laws and whether you are filing as an individual or jointly with your spouse. Seek the assistance of an experienced South Jordan Utah bankruptcy attorney to determine your best options.

What Happens After A Chapter 7 Bankruptcy?

What happens after Chapter 7 bankruptcy can vary from case to case. To a great extent, it will depend on the debts that are discharged by the Chapter 7 bankruptcy.

Debts That Survive A Chapter 7 Bankruptcy

A Chapter 7 bankruptcy will discharge most unsecured debts including credit card debts. However some debts survive a Chapter 7 bankruptcy. These include:

• Tax debts (local, state and federal)

• Tax liens (federal)

• Alimony

• Certain tax advantaged retirement plans

• Payments towards personal injury or wrongful death awards

• Penalties and fines for violation of the law

• Cooperative housing fees

Some debts that survive a Chapter 7 bankruptcy may be discharged under a Chapter 13 bankruptcy subject to certain exceptions. These include:

• Tax obligations that are non-dischargeable

• Property settlement arising from a separation or divorce proceeding

• Payments for property damage

Bankruptcy On Tax Debts

A Chapter 7 bankruptcy can discharge a tax debt subject to the following requirements:

• The debt is an income tax debt. Other tax debts generally survive bankruptcy

• The debtor did not commit willful evasion or fraud

• The debt is not less than 3 years old

• The debtor has filed a tax return

• The debt was assessed by the IRS or not assessed at all. If the debt was assessed, it must have been assessed at least 240 days before the filing.

Student Loan Debt

Student loans generally survive a Chapter 7 bankruptcy. However the debtor can apply for a hardship discharge. The debtor must show that paying the debt would cause undue hardship to the debtor and his or her dependents. The debtor must also demonstrate his or her inability to make the payments at the time of filing the bankruptcy petition and in the future. Debtors who are disabled and unable to work will generally be given a hardship discharge. Debtors who file a Chapter 13 bankruptcy can include the student loan in the repayment plan.

IRS Audit Lawyer

The law does not specifically require the IRS to pay special attention to bankruptcy filers. It would be practically impossible for the IRS to monitor everyone who files for bankruptcy. The IRS mainly targets those who do not file their tax return or file incorrect returns or evade taxes.

Child Support Law

Certain debts will not be wiped out in bankruptcy. Child support obligations are one of them. Child support debt is a priority debt and must be paid in full. The debtor continues to remain liable for child support obligations.

If you are considering bankruptcy speak to an experienced South Jordan Utah bankruptcy lawyer. The lawyer will explain to you the debts that will be discharged in bankruptcy.

Bankruptcy Lawyer South Jordan Utah Free Consultation

When you need legal help to stop foreclosure, stop a tax levy, stop a wage garnishment, or to get your car back after a repossession, please call Ascent Law LLC (801) 676-5506 for your free bankruptcy consultation.

We can help you keep your home, your car and your personal belongings. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Where Can I Get Divorce Papers?

Family Lawyer North Salt Lake Utah

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

South Jordan, Utah

|

South Jordan, Utah

|

|

|---|---|

South Jordan City Hall, March 2006

|

|

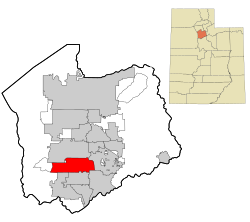

Location in Salt Lake County and the state of Utah.

|

|

| Coordinates: 40°33′42″N 111°57′39″WCoordinates: 40°33′42″N 111°57′39″W | |

| Country | |

| State | |

| County | Salt Lake |

| Established | 1859 |

| Incorporated | November 8, 1935[1] |

| Named for | Jordan River |

| Government

|

|

| • Type | council–manager |

| • Mayor | Dawn Ramsey |

| • Manager | Gary L. Whatcott |

| Area | |

| • Total | 22.31 sq mi (57.77 km2) |

| • Land | 22.22 sq mi (57.54 km2) |

| • Water | 0.09 sq mi (0.23 km2) |

| Elevation

|

4,439 ft (1,353 m) |

| Population | |

| • Total | 77,487 |

| • Density | 3,452.07/sq mi (1,332.86/km2) |

| Time zone | UTC−7 (Mountain (MST)) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP code |

84009, 84095

|

| Area code(s) | 385, 801 |

| FIPS code | 70850 |

| GNIS feature ID | 1432728[4] |

| Website | www |

South Jordan is a city in south central Salt Lake County, Utah, United States, 18 miles (29 km) south of Salt Lake City. Part of the Salt Lake City metropolitan area, the city lies in the Salt Lake Valley along the banks of the Jordan River between the 10,000-foot (3,000 m) Oquirrh Mountains and the 11,000-foot (3,400 m) Wasatch Mountains. The city has 3.5 miles (5.6 km) of the Jordan River Parkway that contains fishing ponds, trails, parks, and natural habitats. The Salt Lake County fair grounds and equestrian park, 67-acre (27 ha) Oquirrh Lake, and 37 public parks are located inside the city. As of 2020, there were 77,487 people in South Jordan.

Founded in 1859 by Mormon settlers and historically an agrarian town, South Jordan has become a rapidly growing bedroom community of Salt Lake City. Kennecott Land, a land development company, has recently begun construction on the master-planned Daybreak Community for the entire western half of South Jordan, potentially doubling South Jordan’s population. South Jordan was the first municipality in the world to have two temples of The Church of Jesus Christ of Latter-day Saints (Jordan River Utah Temple and Oquirrh Mountain Utah Temple), it now shares that distinction with Provo, Utah. The city has two TRAX light rail stops, as well as one commuter rail stop on the FrontRunner.

[geocentric_weather id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_about id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_neighborhoods id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_thingstodo id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_busstops id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_mapembed id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_drivingdirections id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_reviews id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

If we pay our tax debt in full, can we file for bankruptcy? pic.twitter.com/e7cGFzxkPQ

— Tim Cella (@TimCella2) October 11, 2022

What happens to creditors after a company files for bankruptcy?

My answer is here:https://t.co/EQnmebaaBC pic.twitter.com/6xaJ7eWY24

— Tim Cella (@TimCella2) October 13, 2022